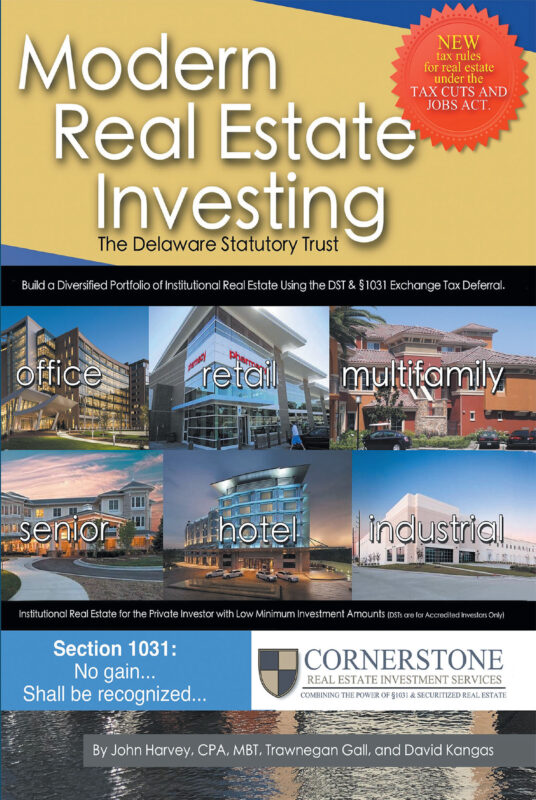

Modern Real Estate Investing

John Harvey CPA, MBT, Trawnegan Gall , and David Kangas

$32.95

Modern Real Estate Investing introduces the nation to a new concept in real estate investment known as the Delaware Statutory Trust (DST). The DST is a synthesis of one hundred years of real estate, s...

Read More

SKU: 9781642983425

Categories: Business & Economics, Investments & Securities - Options

Tags: BUS036040, Page Publishing